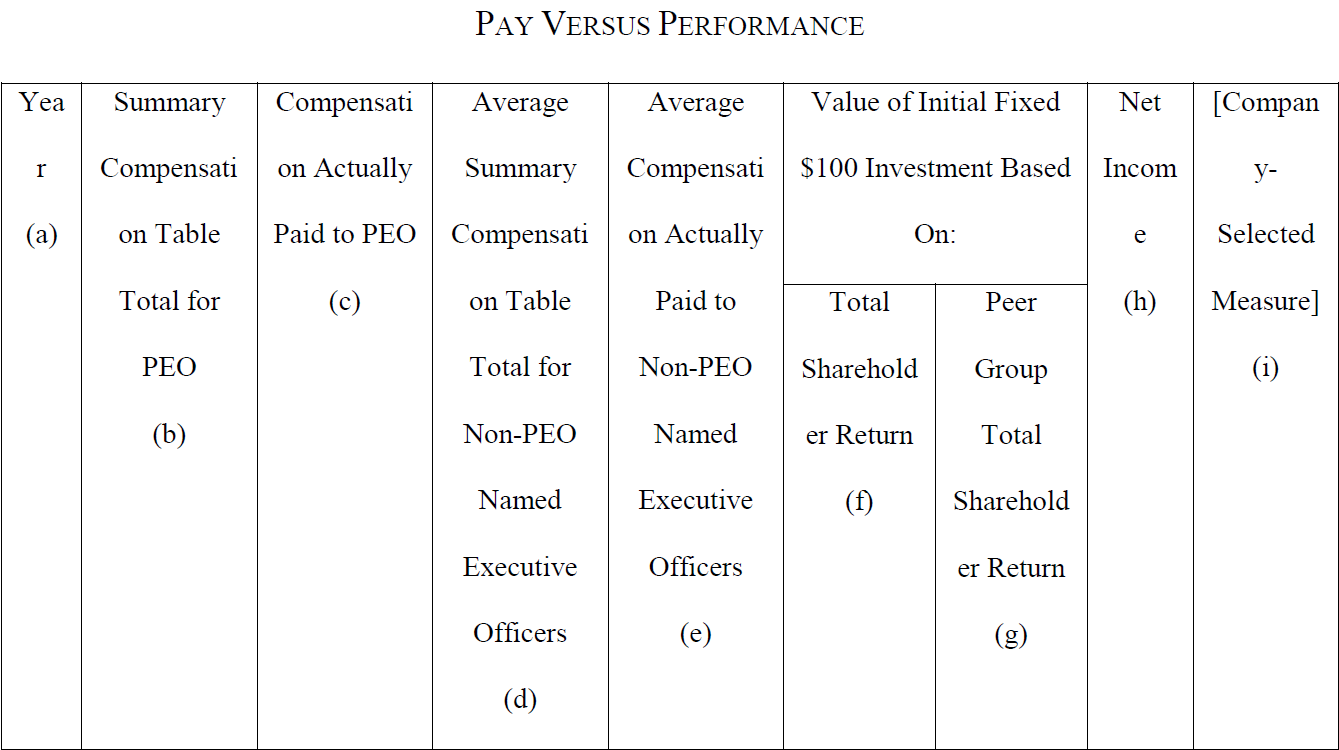

The US Securities and Exchange Commission recently hosted a roundtable to discuss potential updates to executive compensation disclosure requirements. The roundtable highlighted the need to reevaluate the current executive compensation disclosure framework due to complexity, costs, and potential distortion of corporate behavior. Participants debated the effectiveness of current disclosures, such as pay versus performance and CEO pay ratio, and the classification of personal executive security expenses as perquisites.

read more

Subscribe

Subscribe