On August 25, 2022, the US Securities and Exchange Commission (SEC) adopted final rules imposing new mandatory “pay for performance” disclosures for most public companies (foreign private issuers, emerging growth companies and registered investment companies are excluded). These rules implement Section 953(a) of the Dodd-Frank Act, which provided for the SEC to adopt pay for performance rules requiring disclosure in a “clear manner” of the relationship between executive compensation “actually paid” and the company’s “financial performance” taking into account changes in stock value, dividends and distributions.

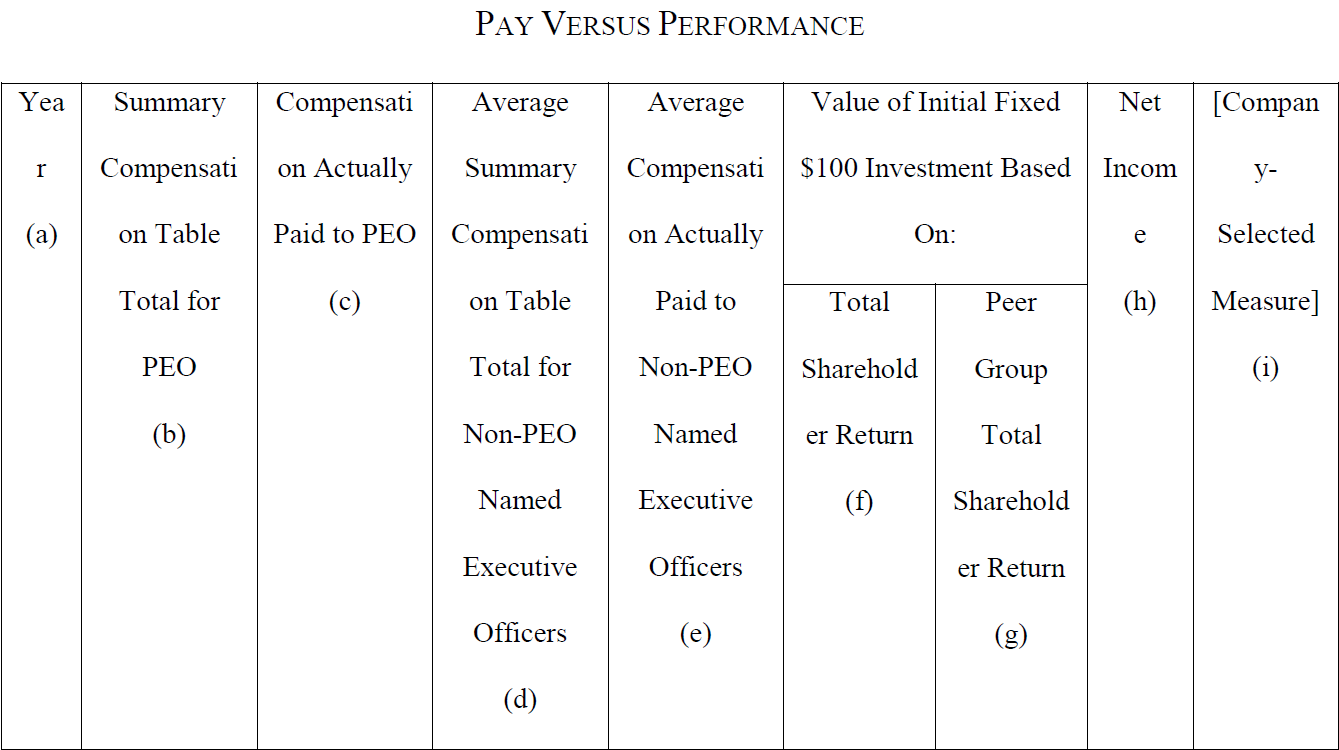

The final rules, which are primarily set forth in Item 402(v) of Regulation S-K, impose the following new tabular disclosure for any proxy statement or information statement for which executive compensation under Item 402 is required:

Important aspects of this table include the following:

- Compensation “actually paid” to both the principal executive officer (PEO) (a/k/a CEO) and, as a group, the other named executive officers in the annual proxy statement, which is a measure that will require calculations different than amounts reported in the Summary Compensation Table, particularly for equity awards and pension benefits.

- Financial performance is to be disclosed with respect to total stockholder return (TSR) for the company, its peer group and net income.

- A public company covered by these rules can choose to use either the peer group used for its 10-K disclosures (under Item 201(d)) or the custom peer group in its CD&A for this table.

- Issuers will be required to identify a “company selected measure” specific to their businesses (other than TSR and net income) that represents the “most important” financial performance measure used to link compensation actually paid to company financial performance.

- The information required by the table is required to cover the five most recently completed fiscal years subject to a transition phase-in rule for 2023 and 2024.

Public companies will also need to provide a clear description of the relationship between each of the financial performance measures in the table and the executive compensation actually paid to its CEO and, on average, its other named executive officers during the lookback period, as well as the relationship between its TSR and the TSR of its peer group.

In addition, public companies will also need to identify the three to seven financial performance measures (or, in some cases, certain non-financial measures) that it determines are its most important measures.

Smaller reporting companies may avail themselves of scaled-back disclosure under Item 402(v), including a shorter lookback period (three years instead of five years) and no requirement to include a custom peer group, a tabular list or a company-selected measure.

Complying with these rules will require changes to existing forms of proxy disclosure. The extent to which these disclosures impact the amount or structure of executive compensation in the long term remains uncertain. The final rules generally apply for filings with respect to fiscal years ending on or after December 16, 2022.

We will be providing a more comprehensive analysis shortly.